2016 Blog Entries

12/20/2016

First on the table is Section 179, allowing businesses to deduct the total purchase price (or lease) of certain equipment and/or software. Total allowable deduction for 2016? $500,000! More information can be found here on the Section 179 website.

Next are the slew of Georgia State tax-credits, specifically the Job Tax Credit. This incentive fuels companies to expand, providing as much as $4,000 in annual tax savings per job. More information on this credit, as well as the many more that Georgia offers can be found here on the Georgia.Org website.

12/2/2016

Ordering Capital equipment, specifically Imaging, can be stressful, especially if you're working with a new vendor. Over the last 15 years in my position as an

Imaging Supervisor I've built a rapport with a number of major OEM's. The thought of doing business with anyone else was very intimidating, not to mention ones credibility is on the line if

anything goes awry. With reimbursements nose-diving, staggering costs to maintain compliancy and accreditation via governing bodies, dramatic loss in productivity when dealing with insurance

companies, and the growing cost to maintain billing staff - just to get paid - one has to deal with this culminated force by trimming overhead expenses.

For those of you that don't keep a pulse on emerging trends, the refurbished medical equipment market here in the US is expected to reach 12 billion dollars by 2021, almost doubling this current

years forecasts. One can strongly assume that within the next five years if you haven't purchased a piece of refurbished medical equipment, odds are you will by 2021.

The looming question remains - who can one trust?

Enter BC Technical.

Our practice just completed the installation of three major additions to our imaging portfolio; a 64 slice GE VCT, a dual-headed GE Ventri dedicated cardiac gamma camera, and an UltraSpect workstation. The initial deal just involved the CT scanner, but because of how much they exceeded my expectations, they were invited to

bid on other projects, which they were successful in procuring. All in all, the entire process from the bidding, negotiating, financing options, and flexibility has quenched any previous

reservations when doing business with a non-OEM entity.

Learn from my experience; don't be complacent. Commit now and start saving!

11/4/2016

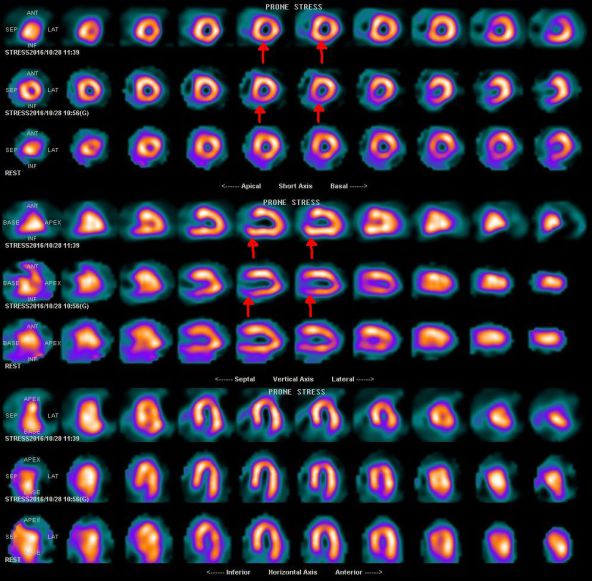

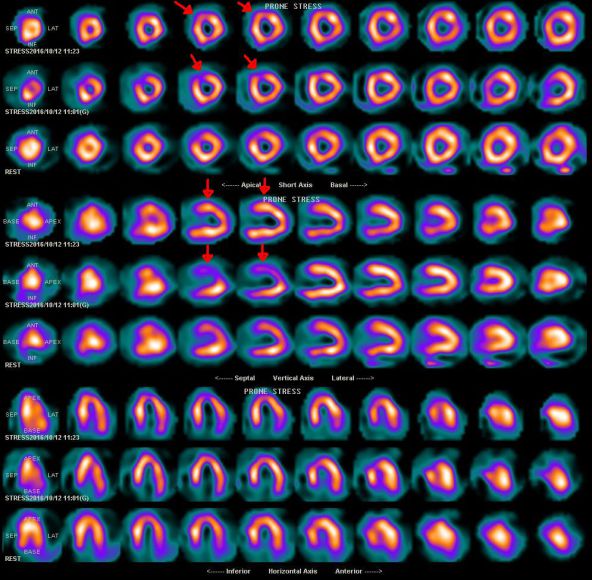

Never underestimate the power of prone imaging, otherwise known as the 'poor man's attenuation correction.'

After its implementation, our false-positives were considerably lower.

10/27/2016

Consistently meeting or exceeding my expectations, these companies have all made my 2016 recommended vendor list:

Inventory Distributors - Henry Schein, Lynn Medical

Pharmaceutical Distributor – Henry Schein

GPO – Intalere, Vizient

Radiopharmacy Services - Cardinal Health

Dosimetry Badges – Radiation Detection Company

Imaging Equipment Providers – GE Healthcare, BC Technical

Field Service Engineers – GE Healthcare

Power Backups - Powercom

Financing – GE Capital

Flood Source Provider – Lynn Medical

Physicist Services – Alliance Medical Physics

Radiation Monitoring Equipment Distributor – Medi-Nuclear

Scaler/GM Counter Calibration Services – Technical Services Group

Biowaste Management – MedPro

Patient Snacks/Beverages – Capital Office Products

EMR Client – eClinicalWorks

HR Services – ADP

Treadmill Stress Systems – Jaken Medical

Commercial Cleaners – Coverall

Radiopharmaceutical Management System – Syntrac

Hardware Based Resolution Recovery – UltraSPECT

Biomedical Services – Medical Maintenance Consultants

Nuclear Reporting Software – NRP by Syntermed

Nuclear Cardiology Processing – Emory Cardiac Toolbox by Syntermed

PACS – Genesis OmniVue

Linen Service – Southern Medical Linen Service

Georgia CON/LNR Legal Counseling – Ray & Sherman, LLC

10/10/2016

That time I asked Bracco for two vials of CardioTec.

Bracco CardioTec.pdf

Adobe Acrobat document [54.2 KB]

10/7/2016

Ever wonder why so many Fortune 500 companies are moving to Georgia? It's the tax exemptions and credits!

Here are the ones relevant to Healthcare:

(6) Sales to any Hospital Authority created by Article 4 of Chapter 7 of Title 31 of the Georgia Code.

(7) Sales of tangible personal property and services used

specifically in the treatment function when the sales are to a nonprofit (i.e., a tax exempt organization under the Internal Revenue Code) nursing home, inpatient hospice, general hospital or mental

hospital. Application process is through Form ST-NH1.

(7.05) From July 1, 2015 through June 30, 2018, sales of tangible

personal property to a nonprofit health center in this state which has been established under the authority of and is receiving funds pursuant to, the United States Public Health Service Act, 42 U.

S. C. Section 254b if such health clinic obtains an exemption determination letter from the commissioner. Application process is through Form ST-NHC. Annual application required. Application must be

filed electronically through the Georgia Tax Center. Qualifying sales are exempt from the 4% state sales tax. These sales are subject to all local sales taxes.

(7.3) From July 1, 2015 to June 30, 2018, sales of tangible property and services to a nonprofit volunteer health clinic primarily treating patients with incomes below 200% of the poverty level and which property and services are used exclusively in performing a general treatment function when such clinic is a tax exempt entity under the Internal Revenue Code and obtains an exemption determination letter from the Commissioner. Application is through Form ST-NVHC. Annual application required. Application must be filed electronically through the Georgia Tax Center.

(47) Sales or use of drugs that are lawfully dispensable only by prescription for the treatment of natural persons; Insulin regardless of whether the insulin is dispensable only by prescription; prescription eyeglasses and contact lenses; drugs dispensable by prescription for the treatment of natural persons without charge to physicians, hospitals, etc. by pharmaceutical manufacturers or distributors; drugs and durable medical equipment dispensed or distributed without charge solely for the purposes of a clinical trial approved by the FDA or an institutional review board. Note: This exemption does not include over-the-counter drugs, drugs sold for animal use, or nonprescription eyeglasses.

(50) Sales of insulin syringes and blood glucose level measuring strips dispensed without a prescription.

(51) Sales of oxygen when prescribed by a licensed

physician

(52) Sale or use of hearing aids.

(54) Sale to or use by a patient of any prescribed durable medical equipment or prescribed prosthetic device.

(72) The sale to or use by a patient of all mobility enhancing equipment prescribed by a physician.

10/6/2016

One of the most frustrating, and equally confounding, challenges for Healthcare providers in Georgia (historically has been a red state, yet this law completely defies laissez faire), is the CON filing process through the Georgie Department of Community Health. The supposed purpose behind the law is to 'ensure the availability of adequate health care services to meet the needs of all Georgians, while safeguarding against the unnecessary duplication of services that perpetuate the costs of health care services.' Below are a list of all projects that require a CON:

- New hospitals, including general, acute-care and specialty hospitals

- New or expanding Nursing Homes and Home health agencies

- All multi-specialty and certain single-specialty Ambulatory Surgery Centers

- Providers of Radiation Therapy, Positron Emission Tomography, Open Heart Surgery, and Neonatal Services

- Major medical equipment purchases or leases (e.g. MRI, CT Scanners) that exceed the equipment threshold

- Major hospital renovations or other capital activities by any health care facility that exceed the capital expenditure threshold

- Before a health care facility can offer a health care service, which was not provided on a regular basis during the previous 12-month period, or add additional beds

Thresholds as of July 2016:

Capital Expenditures, O.C.G.A. § 31-6-40(a)(2) $ 2,903,530

Single-Specialty Physician-Owned Ambulatory Surgery Facilities, O.C.G.A. § 31-6-47(a)(18) $ 2,903,530

Joint Venture Ambulatory Surgery Centers, O.C.G.A. § 31-6-47(a)(19) $ 5,807,061

Equipment, O.C.G.A. § 31-6-40(a)(3) $ 1,246,165

During the filing process, what's commonly not mentioned is the legal counseling that specializes in CON/LNR law is highly recommended. Most projects fail to take

into account these costs which can easily breach five figures, even with the simplest of projects.

Recent reports have questioned this laws efficacy, now enforced in 35

states, with the latest stating it diminishes quality of care and in some cases even raises death rates. The Fiscal Times has a great article

shedding some light on this failed policy.

9/30/2016

Highly recommend paying Becker's website a visit. Very few have the pulse on Healthcare like they do.

9/21/2016

Questioning your processing techniques? Both Cedars and Ectoolbox do a great job of supporting their users by posting tutorials and operating manuals.

Here are Cedars Tutorials

Here is Ectoolbox's operating instructions